does idaho have capital gains tax

However the state does not charge this capital gains tax on the. There are only nine states without capital gains taxes.

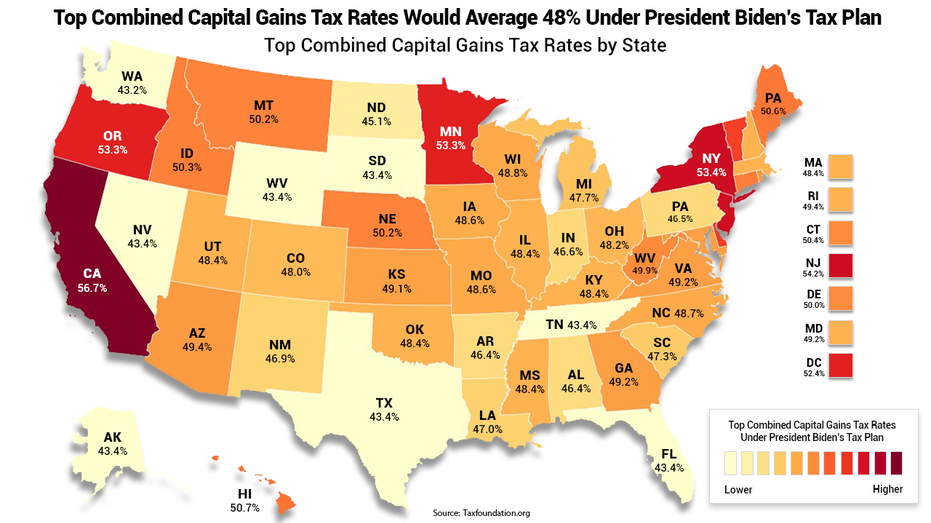

How High Are Capital Gains Taxes In Your State Tax Foundation

There are also ways to offset the costs of your capital gain so that even if you do have to pay the tax it can be minimized.

. These would just be taxed as normal income. Detailed Idaho state income tax rates and brackets are available on this page. Idaho allows a deduction of up to 60 of the capital gain net income from the sale or exchange of qualifying Idaho property.

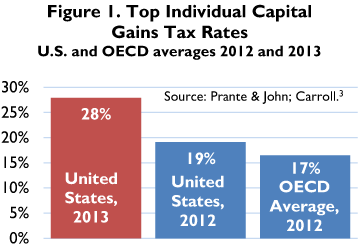

Idaho does not have a special tax rate for gains and losses on stocks bonds or other intangibles. In Idaho the uppermost capital gains tax rate was 74 percent. In simple terms whether you sell a stock or receive a dividend you.

However theyll pay 15 percent on capital gains if their. The sales tax rate in Idaho is currently 6. Use the Idaho Relay Service TDD 800 377-3529 taxidahogov Property Tax.

Idaho does not levy an inheritance tax or an estate tax. 208 334-7660 or 800 972-7660 Fax. Taxes capital gains as income and the rate reaches 575.

Idaho axes capital gains as income. The rate reaches 693. Capital gain net income is the amount left over when you reduce your gains by your.

Object Moved This document may be found here. A homeowner with a property in Boise worth 250000 would then pay 2003 for. Capital gain net income included in federal taxable income from the sale of Idaho property.

Your average tax rate is 1198 and your marginal tax rate is 22. Idaho does have a deduction of up to 60 of the capital gain net income of qualifying Idaho property. For tax year 2001 only the deduction was increased to 80 of the qualifying capital gain net income.

You must complete Form CGto compute your Idaho capital gains deduction. The Idaho income tax has seven tax brackets with a maximum marginal income tax of 692 as of 2022. Taxes capital gains as income and the rate.

The 238 percent figure includes the top tax rate on capital gains plus the 38 percent tax on investment income for high-income taxpayers which helps fund the Affordable Care. Calculate Your Capital Gains Tax. Real or tangible personal property not located in Idaho Level Up is a gaming function not a real life function.

This marginal tax rate means that. If you found this answer helpful please press the. Does Idaho have an Inheritance Tax or an Estate Tax.

The state of Idaho charges a capital gains tax when individuals sell investments that have appreciated in value. To put this into perspective a home in Boise Idaho Ada County has a property tax rate of 801. A majority of US.

Capital gains taxes can be avoided when inheriting capital assets through the step-up in basis provision. Gains from the sale of the following dont qualify for the deduction. If you make 70000 a year living in the region of Idaho USA you will be taxed 12366.

Capital Gains Tax Calculator 1031 Crowdfunding

Council Connection Lewis Introduces Progressive Revenue Plan For Permanent Supportive Housing

Capital Gains Taxes Are Going Up Tax Policy Center

Cryptocurrency Taxes What To Know For 2021 Money

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

Idaho Qualified Small Business Stock Qsbs And Investor Tax Incentives Qsbs Expert

Capital Gains Tax Calculator Estimate What You Ll Owe

Idaho 2022 Sales Tax Calculator Rate Lookup Tool Avalara

The High Burden Of State And Federal Capital Gains Taxes Tax Foundation

Idaho Estate Tax Everything You Need To Know Smartasset

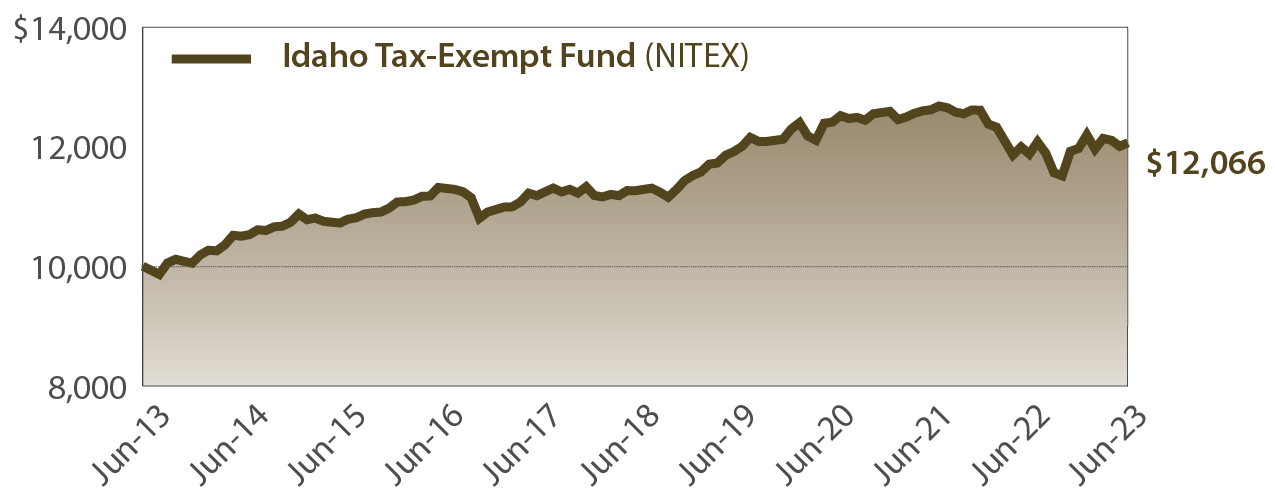

Idaho Tax Exempt Fund Saturna Capital

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Form Cg Fillable Idaho Capital Gains Deduction 06 19 2014 F

State Taxation As It Applies To 1031 Exchanges

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Idaho State Tax Guide Kiplinger

Biden S Proposed Capital Gains Tax Hike Might Hit Wealthy Americans With 57 Rate Study Shows Fox Business